nebraska sales tax calculator vehicle

The Nebraska state sales and use tax rate is 55 055. Registration Fees and Taxes.

Nebraska collects a 55 state sales tax rate on the purchase of all vehicles.

. My Vehicle Title What does a. The statistics are grouped by county. If you are unsure call any local car dealership and ask for the tax rate.

How to Calculate Nebraska Sales Tax on a Car. Nebraska Exemption Application for Sales and Use Tax 062020 4. Motor vehicle sales tax collection information is compiled from monthly county treasurers reports.

The county the vehicle is registered in. You must have the vehicles VIN vehicle identification number in order to get an estimate. You can use our Nebraska Sales Tax Calculator to look up sales tax rates in Nebraska by address zip code.

If you are unsure call any local car dealership and ask for the tax rate. Maximum Possible Sales Tax. You can calculate the sales tax in Nebraska by multiplying the final purchase price by 055.

Sales tax is calculated using the percentage of the items value that must be paid in addition to the full price of the item. If you are unsure call any local car dealership and ask for the tax rate. The statewide sales tax for Nebraska is 55 for any new or used car purchases.

For example lets say that you want. Nebraska collects a 55 state sales tax rate on the purchase of all vehicles. My Vehicle Title What does a.

Nebraska Exemption Application for Common or Contract Carriers Sales and Use Tax - Includes Schedule A. This calculator can help you estimate the taxes required when purchasing a new or used vehicle. My Vehicle Title What does a.

Average Local State Sales Tax. 425 motor vehicle document fee. While some counties forgo additional costs most will charge a local tax on top of the state.

The nebraska state sales and use tax rate is 55. The point of delivery determines the location of the sale. Driver and Vehicle Records.

Omaha Ne Sales Tax Calculator. The calculator will show you the total sales tax amount as well as the county city. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023 Updated.

Once the msrp of the vehicle is established a base tax set in nebraska motor vehicle. Nebraska State Sales Tax. Request a Business Tax Payment Plan.

2022 August 2022 and August 2021. Sales and Use Tax. The sales tax rate is calculated at the rate in effect at that location.

Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less. Nebraska collects a 55 state sales tax rate on the purchase of all vehicles. You can obtain an online vehicle quote using the Nebraska DMV website.

In Nebraska the sales tax percentage is 55 meaning. Find Your States Vehicle Tax Tag Fees When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including. Make a Payment Only.

Sales Tax Rate Finder. Deliveries into a Nebraska city that imposes a local sales tax are. Maximum Local Sales Tax.

Rate of 55 in Nebraska this means you are.

Nebraska Vehicle Sales Tax Fees Calculator Find The Best Car Price

Nebraska Car Sales Tax Reviews And Estimates Getjerry Com

Free Business Sales Tax Calculator Calculate Your Tax Now With Clickfunnels

Avatax Sales Tax Calculation Software Avalara

Nebraska Online Vehicle Tax Estimator Gives Citizens Tax And Fee Estimates

Sales Tax On Cars And Vehicles In Nebraska

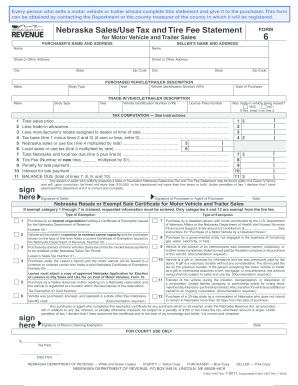

Nebraska Vehicle Sales Tax Form Fill Out And Sign Printable Pdf Template Signnow

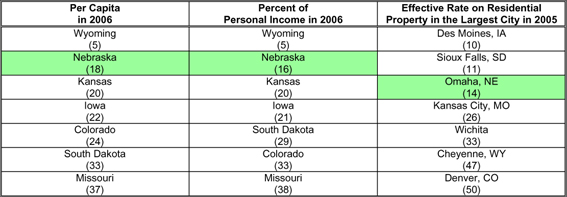

Taxes And Spending In Nebraska

![]()

Registration Fees And Taxes Nebraska Department Of Motor Vehicles

Taxes And Spending In Nebraska

Taxes And Spending In Nebraska

Nebraska Income Tax Ne State Tax Calculator Community Tax

States With The Highest Lowest Tax Rates

Taxes And Spending In Nebraska

Form 6 Fillable Nebraska Sales Use Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales 8 2012